The Goals and Functions of Financial Management

3M is one of those companies that is more adept than others at creating products, marketing those products, and being financially astute. 3M is the world leader in optical films, industrial and office tapes, and nonwoven fabrics. Consumers may recognize 3M as the maker of Post-it notes, Scotch tape, and sponges, in addition to thousands of other diverse products such as overhead projectors and roofing granules.

The company has always been known for its ability to create new products and markets and, at times, as much as 35 percent of their sales have been generated from products developed in the previous five years. In order to accomplish these goals, 3M’s research and development has to be financed, the design and production functions funded, and the products marketed and sold worldwide. This process involves all the functions of the business.

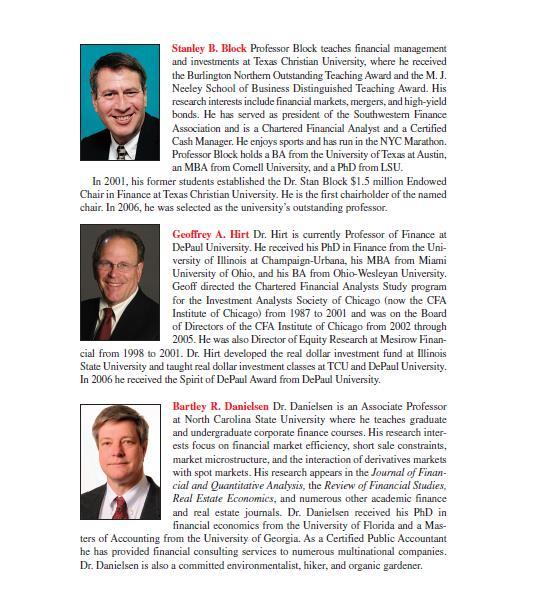

Author

Did you ever stop to think about the importance of the finance function for a $25 billion multinational company like 3M where 64 percent of sales are international? Someone has to manage the international cash flow, bank relationships, payroll, purchases of plant and equipment, and acquisition of capital. Financial decisions must be made concerning the feasibility and profitability of the continuous stream of new products developed through 3M’s very creative research and development efforts.

The financial manager needs to keep his or her pulse on interest rates, exchange rates, and the tone of the money and capital markets. In order to have a competitive multinational company, the financial manager must manage 3M’s global affairs and react quickly to changes in financial markets and exchange rate fluctuations. The board of directors and chief executive officer rely on the financial division to provide a precious resource—capital—and to manage it efficiently and profitably. If you would like to do some research on 3M, you can access its home page at www.3m.com. If you would like to understand more about how companies make financial decisions, keep reading.

Economic variables, such as gross domestic product, industrial production, disposable income, unemployment, inflation, interest rates, and taxes (to name a few), must fit into the financial manager’s decision model and be applied correctly. These terms will be presented throughout the text and integrated into the financial process. Accounting is sometimes said to be the language of finance because it provides financial data through income statements, balance sheets, and the statement of cash flows.

The financial manager must know how to interpret and use these statements in allocating the firm’s financial resources to generate the best return possible in the long run. Finance links economic theory with the numbers of accounting, and all corporate managers—whether in production, sales, research, marketing, management, or long-run strategic planning—must know what it means to assess the financial performance of the firm.

Many students approaching the field of finance for the first time might wonder what career opportunities exist. For those who develop the necessary skills and training, jobs include corporate financial officer, banker, stockbroker, financial analyst, portfolio manager, investment banker, financial consultant, or personal financial planner. As the student progresses through the text, he or she will become increasingly familiar with the important role of the various participants in the financial decision-making process. A financial manager addresses such varied issues as decisions on plant location, the raising of capital, or simply how to get the highest return on x million dollars between 5 o’clock this afternoon and 8 o’clock tomorrow morning.

0 comments:

Tell us your opinion about this blog site